Edition 3

At Haven Green we meet managers with unique strategies and partner with a select few

It has been a busy few months as we have been adding to our roster of exciting investment solutions, including strategies in Private Credit (US lower mid-market senior secured loans), Private Equity (China PE), Asia Fixed Income, and Life Sciences focused Venture Capital (providing risk capital and expertise to life sciences and companies in Europe and US)

Paul Price - Founder and CEO

In this newsletter we are pleased to share just some of the insights and updates from our excellent partner managers across a variety of themes and asset classes.

We remain committed to our core philosophy of increasing the allocation of capital in areas that make positive impacts to the world, providing alignment between investors and investment managers with the broader objectives of society - and look forward to continuing this journey together.

Paul Price, Founder and CEO

Less than one week to go until 2024's SuperReturn International kicks off at the InterContinental Hotel in Berlin.

We are very much looking forward to a productive few days of innovative idea discussions, insight sharing and catching up with new and old friends alike.

This year, we are delighted that two of our exceptional partners will be joining us in Berlin - senior executives from both Alpha Intelligence Capital and NXT Capital will be on site throughout the event so please make sure to stop by our table near the Bellevue Conference area (very near to the main coffee area) or book a time directly using the Calendly link below.

Webinars

At Haven Green we have had some fascinating discussions with our partners over the last few months - from discussions around the enormous transformative potential of AI for good, to how geopolitics and policy will influence renewable power in a big election year. Catch the playbacks to these, and other conversations on our Insights Page

In discussion with AIC, as one of the few global funds dedicated to advanced AI technology investments, AIC focuses on the “solutions & applications” of AI in high impact verticals: cybersecurity, healthcare, biotechnology and computing architectures.

We spoke with Co-Founder and Managing Partner Antoine Blondeau on the key verticals he is investing across, how he has deployed capital to date and some of the lessons he has learnt along the way. List back here.

In discussion with Ecofin, Max Slee, PM of Ecofin Energy Transition strategy, joined us for a timely webinar, discussing whether decarbonisation is still competitive, how geopolitics and policy will influence renewable power in a big election year and debunked some of the myths around the Energy Transition. Listen back here.

Upcoming Webinar

We are thrilled to have recently partnered with LionGlobal Investors, a full coverage Asian specialist, with a 36 year history and multi-dimensional analysis of Asian markets.

We will be joined by LionGlobal Investors on Wednesday 3rd July at 2pm BST for a 30-minute webinar around Asian Fixed Income. We will be discussing how the end of the interest rate hiking cycle could create a favourable environment for bond investments and with Asia continuing to lead global economic growth, how Asia IG and HY offer higher yields and/or lower durations relative to peers.

To register for the webinar, please click on the button below.

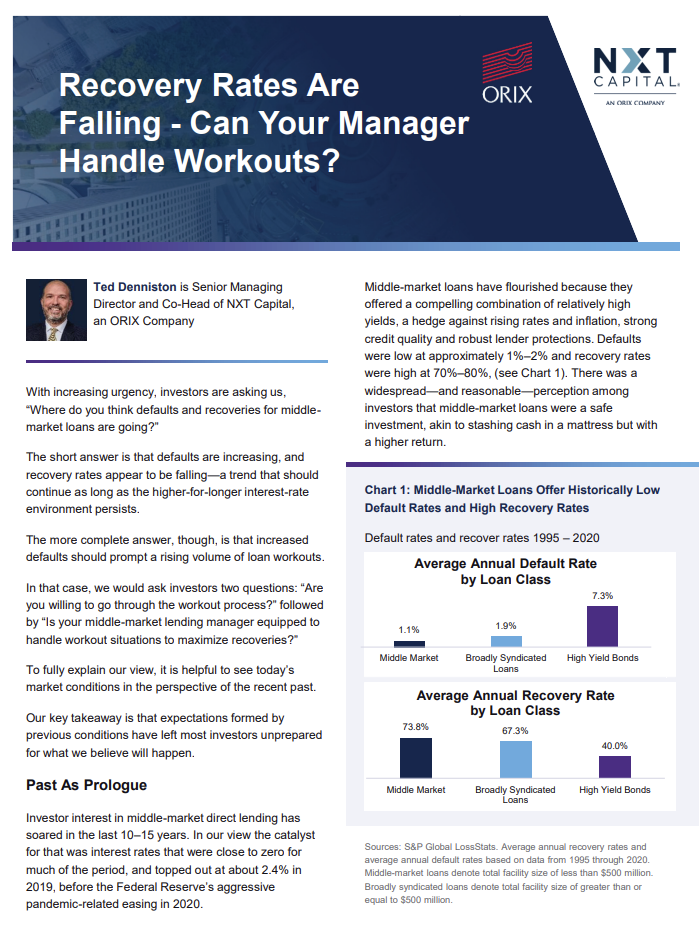

NXT Capital is a US Middle Market Private Debt manager. The firm was established in 2010 and was acquired by the ORIX corporation in 2018. The team, with over 25 years of experience of sustaining middle-market lending platforms over economic cycles to produce risk-adjusted returns in various market conditions, is focused on actively managing the less efficient lower middle market.

They are currently raising for Fund VII, closing October 2024.

With increased defaults potentially prompting a rising volume of loan workouts, it is essential that your middle-market lending manager is equipped to handle workout situations to maximize recoveries. In a market where many direct lenders offer workout

capabilities it is helpful to understand the nuances that differentiate those who “offer” these capabilities and those who have these capabilities ingrained in their DNA as a firm.

In this piece, Ted Denniston, Senior Managing Director and Co-Head of NXT Capital, explores this topic and discusses the deeper questions investors should ask when evaluating the right manager.

Hotchkis & Wiley is an employee-owned firm founded in 1980, employing a value philosophy and time-tested approach that outperforms through cycles. We believe that interest in Value investing has to be welcomed. Portfolios need to be adjusted for the new normal of inflation and higher interest rates and the over reliance on pure growth strategies as the salvation of everything.

H&W Global Value Portfolio Manager Scott Rosenthal recently joined the podcast series to provide an update on performance in the first quarter of 2024 and where he is finding opportunity in global markets. Listen by clicking on the button below.

Market mispricing of corporate sustainability can be exploited to generate better risk-adjusted returns. Osmosis Investment Management targets excess returns through the identification of Resource Efficiency in listed companies. They define Resource Efficiency as the Carbon emitted, Waste generated and Water consumed, relative to value creation. Their portfolios overweight efficient companies and underweight, or short, inefficient companies as identified by the Osmosis Model of Resource Efficiency.

Osmosis has recently celebrated a significant new milestone - the Resource Efficient Core Equity (UCITS) Fund has surpassed US$1 billion in assets under management! This is an exceptional milestone for a Fund dedicated to the environment.

When the Core Equity Strategy was developed in 2017, the team wanted to ensure that the risk budget allocated by clients to reduce the portfolio's environmental footprint was not left unrewarded. The performance of the Fund from both a financial and an environmental perspective has evidenced that investing sustainably and delivering better risk-adjusted returns is feasible, even during challenging market environments.

Tenax Capital, a multi-strategy asset manager with a dedicated team for Catastrophe Bonds, celebrated a record performance in a record year. With a net total return of 17.9%, Tenax ranks as the top performer ILS manager in the UCITS universe for the full year 2023.

In their latest update, Tenax investigates the nature of the current pricing environment and looks for signs of dislocation within specific perils or triggers, with a particular focus on the dynamics currently impacting industry loss trigger bonds - a very worthwhile read for those who want to understand the wider opportunity set in bond allocations.

To hear more information on any of our partner managers, or to receive regular strategy updates, please speak to your Haven Green Sales representative or send us a mail at info@havengreen.eu.